Imagine you’re an accountant, swamped with spreadsheets and financial data. You’ve been working late nights just to keep up. Suddenly, a superhero flies in through your office window – not Superman or Wonder Woman, but something much better: ChatGPT for accounting.

ChatGPT is a generative AI-powered chatbot that can handle tedious processes and automate mundane tasks, so you don’t have to work late nights. It’s like having a dedicated accounting assistant who never gets tired!

Hold on tight because we’re about to dive into how ChatGPT for accounting can transform your firm forever.

Table of Contents:

- Understanding ChatGPT for Accounting

- Automating Accounting Tasks with ChatGPT

- Enhancing Financial Reporting and Compliance with ChatGPT

- Improving Cash Flow Management with ChatGPT

- The Future of Accounting with AI

- How to Implement ChatGPT in Your Accounting Practice

- FAQs About ChatGPT for Accounting

Understanding ChatGPT for Accounting

If you’re curious about the role of AI in accounting, then let’s chat about ChatGPT.

Don’t be confused – this isn’t a regular computer program. It’s an AI model known as a Generative Pre-trained Transformer (GPT) that uses machine learning to make sense of natural language processing. Yes, we’re talking sophisticated tech.

So, how does ChatGPT work? Well, think of it as a highly intelligent student who has read and understood billions of lines from books and websites. In simpler terms – it can generate human-like text based on what it has learned. This makes tasks like analyzing financial data or creating invoices seem like child’s play.

You might be wondering how all this translates into the world of balance sheets and tax returns. I mean, after all, aren’t these jobs best left to seasoned accountants?

Sure, they are, but imagine if you had a smart assistant capable of helping with routine tasks such as entering data or generating financial reports. That’s where ChatGPT comes in handy.

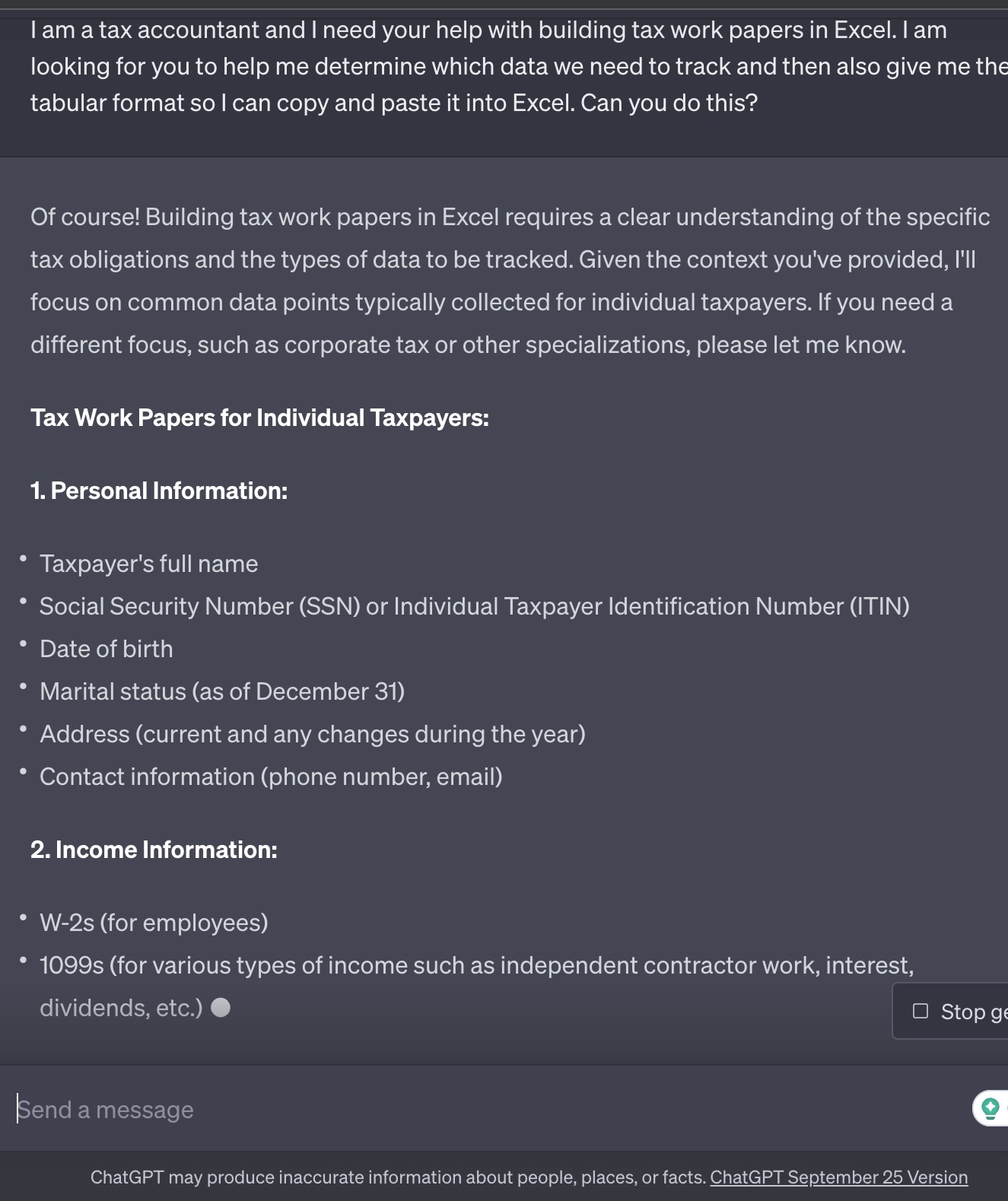

Here’s an example of how ChatGPT for accounting works:

By analyzing cash flow statements, the tool can analyze complex data, automate bookkeeping chores, generate accurate income statements, and provide significant financial health insights, ultimately easing processes and routine bookkeeping activities.

And it doesn’t stop there. In the accounting field, ChatGPT can help in strategic planning by providing data-driven projections based on past trends and current market conditions. This helps professionals make more informed decisions – a game-changer for those in the business of crunching numbers.

When you bring all these features together, it’s clear to see just how powerful they can be.

Automating Accounting Tasks with ChatGPT

ChatGPT can be used to automate a variety of accounting tasks, including:

- Improving customer service: ChatGPT can interact with clients just like a human would, answering their questions and providing assistance. This frees up accountants to focus on other tasks and ensures that clients receive consistent, high-quality responses.

- Reducing manual data entry: ChatGPT can automatically enter data into spreadsheets, financial statements, and other accounting documents. This saves accountants time and reduces the risk of errors.

- Creating invoices and categorizing expenses: ChatGPT can generate invoices and categorize expenses based on predefined categories. This automates mundane but important tasks, freeing up accountants to focus on more strategic work.

- Generating financial projections and ensuring tax compliance: ChatGPT can generate accurate financial projections and identify potential tax liabilities. This helps accountants to make informed decisions and ensure that their clients are compliant with tax laws.

Benefits of using ChatGPT for accounting:

- Increased efficiency: By automating routine tasks, ChatGPT can help accountants to be more efficient. This can lead to faster turnaround times and fewer errors.

- Improved accuracy: ChatGPT can help to improve the accuracy of accounting work by reducing the risk of human errors.

- Reduced workload: ChatGPT can free up accountants from time-consuming tasks, allowing them to focus on more strategic and value-added work.

- Enhanced customer service: ChatGPT can provide clients with 24/7 support and answer their questions quickly and accurately.

ChatGPT is a powerful tool that can help accountants automate tasks, improve efficiency, and provide better customer service. If you are looking for a way to streamline your accounting practice, ChatGPT is worth considering.

Enhancing Financial Reporting and Compliance with ChatGPT

With the increasing complexity of financial reporting, keeping up can feel like a tightrope walk. The good news? ChatGPT is here to help.

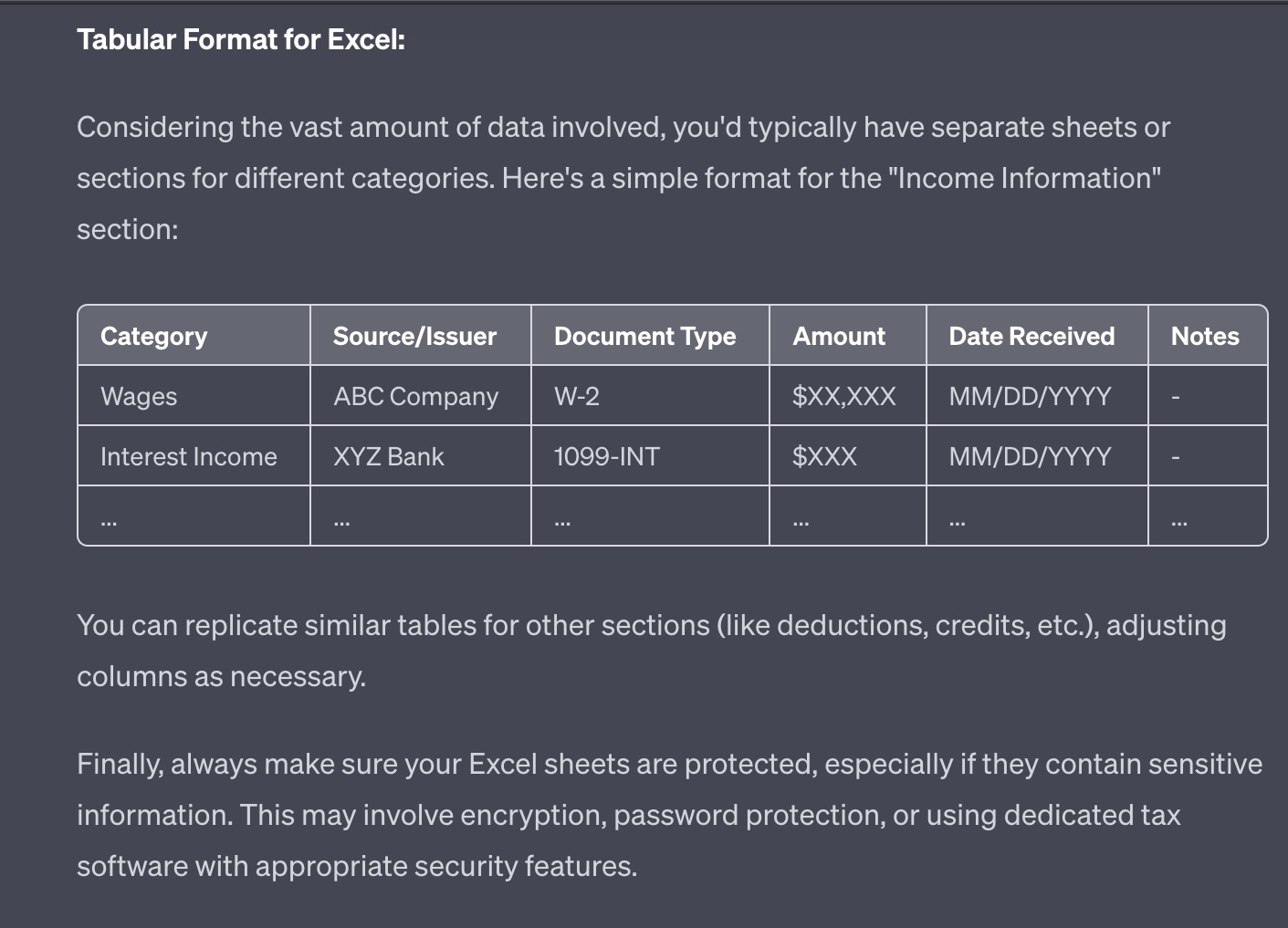

Here are some steps you can use to generate financial reports with ChatGPT:

- Step 1: Provide ChatGPT with the necessary data. This could include financial statements, such as the balance sheet, income statement, and cash flow statement.

- Step 2: Prompt ChatGPT to generate a financial report. For example, you could prompt the tool to generate a “balance sheet for the period ending December 31, 2023” or an “income statement for the year ending December 31, 2023.”

- Step 3: The tool will generate the report based on the data you provided and its knowledge of financial accounting. The report will be formatted in a standard format, such as XBRL or PDF.

Here’s a detailed prompt you can use to get help analyzing financial reports:

You are a financial analyst, with expertise and experience in analyzing financial reports and statements to measure the success and growth of businesses. Your role involves interpreting and evaluating financial data, such as income statements, balance sheets, and cash flow statements, to assess the financial health and performance of a company. By analyzing key financial ratios, trends, and benchmarks, you provide valuable insights and recommendations to stakeholders, helping them make informed decisions and drive the growth of the business. As a financial analyst, your task is to maximize business growth through effective financial analysis using reports and statements. Your goal is to provide insights and recommendations to help businesses make informed decisions and improve their financial performance. To achieve this, you should analyze financial reports and statements, such as balance sheets, income statements, and cash flow statements. Identify key financial indicators, trends, and patterns that can impact business growth. Additionally, you should assess the financial health of the company, identify areas of improvement, and propose strategies to optimize financial resources. Your output should be a comprehensive financial analysis report, including an executive summary, key findings, recommendations, and supporting data. The report should be in a professional format, such as a PDF or Word document, and should be easily understandable by both financial and non-financial stakeholders.

Apart from generating accurate financial reports, this powerful tool also assists in detecting fraudulent activities within your transactions.

In fact, leveraging OpenAI’s ChatGPT, you can easily analyze vast data sets and ensure compliance with tax laws and accounting standards more efficiently than ever before. You see, AIs have an uncanny ability to spot patterns humans might miss. This means they’re perfect for tasks such as evaluating financial statements or balance sheets for discrepancies that could indicate fraud.

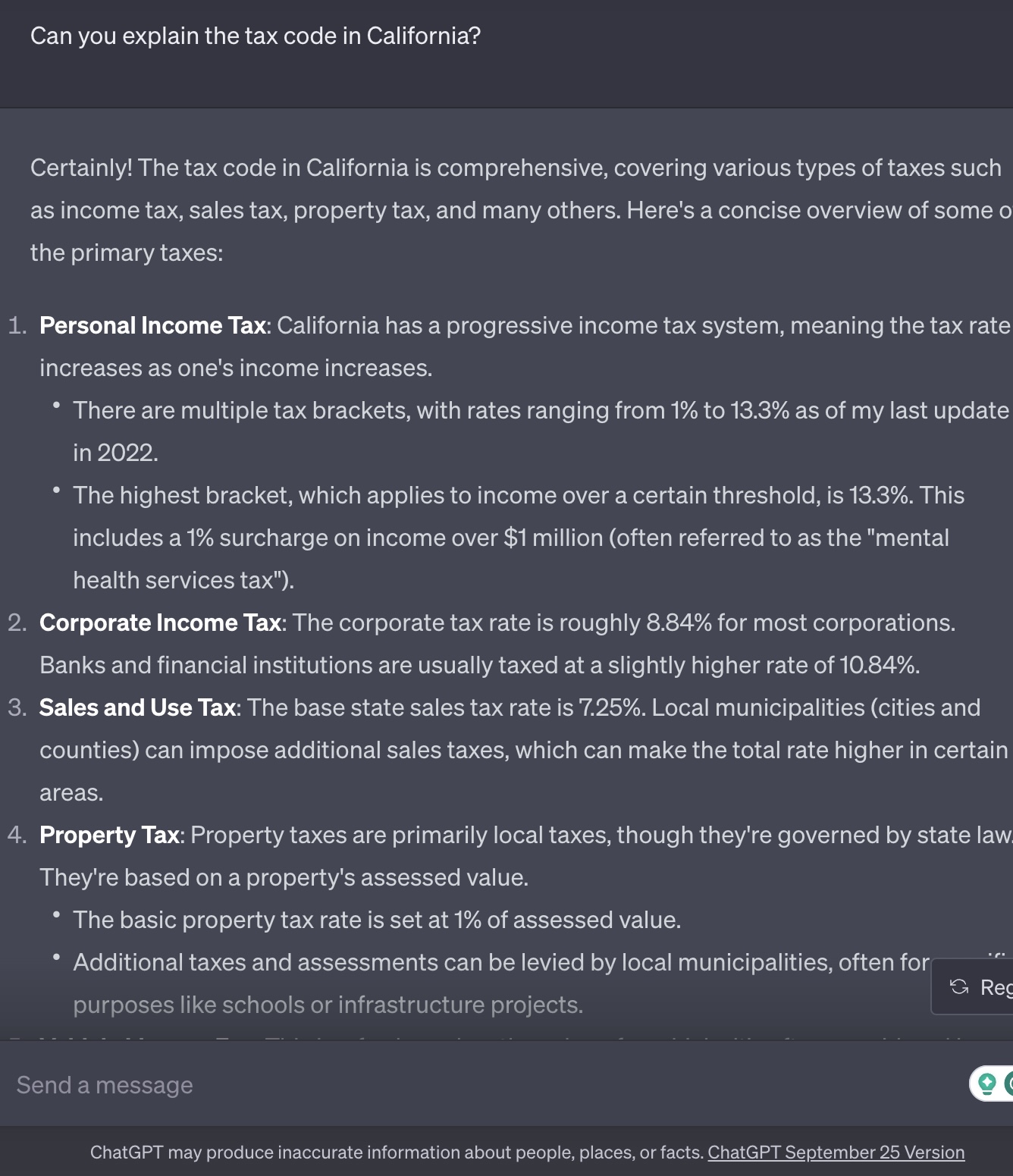

ChatGPT can also help you out with tax codes.

These aren’t exactly light reading material – but luckily, we’ve got AI on our side. Through machine learning techniques coupled with natural language processing capabilities, OpenAI’s GPT models provide accurate interpretations of complex tax laws across various jurisdictions.

This not only simplifies your path to understanding these regulations but also ensures all aspects of your operations remain compliant.

Improving Cash Flow Management with ChatGPT

ChatGPT can be a game-changer for cash flow management in accounting. This powerful tool uses machine learning and natural language processing to analyze vast data sets from your financial reports and helps you identify trends and anomalies in your income statements, balance sheets, and, most importantly, cash flow statements.

With the insights provided by ChatGPT’s analysis of historical data, it becomes possible to forecast future cash flows accurately.

Here’s an example of a prompt from our AI prompt library that turns ChatGPT into an expert in managing cash flow:

You are a financial analyst, with expertise and experience in managing cash flow for financial stability. Some strategies for tracking and managing cash flow include creating a detailed budget, regularly monitoring and analyzing cash flow statements, implementing cash flow forecasting, optimizing accounts receivable and accounts payable processes, and maintaining a cash reserve for emergencies. Additionally, utilizing financial management software and seeking professional advice can also contribute to effective cash flow management and ensuring financial stability. Develop a comprehensive cash flow management strategy to ensure financial stability. Start by analyzing the current cash flow situation, including income sources, expenses, and any existing financial obligations. Identify areas of improvement and potential risks that may impact cash flow. Provide recommendations on how to optimize cash flow, such as implementing effective budgeting techniques, managing accounts receivable and payable, and exploring opportunities for cost reduction. Additionally, outline strategies for maintaining a healthy cash reserve and planning for future financial needs. The output should be a detailed cash flow management plan, including specific actions to be taken, timelines, and projected outcomes.

Beyond generating financial reports based on past performance, leveraging ChatGPT allows for accurate financial projections that account for various factors like market trends or changes in tax laws—providing valuable insights for strategic planning.

No one likes surprises when it comes to finance. So wouldn’t it be great if we could foresee potential issues?

An advantage of using AI tools like ChatGPT, beyond automating routine tasks such as report generation or creating invoices, is their ability to predict potential problems before they become real headaches. From unusual fluctuations in credit card expenses based on predefined categories to detecting inconsistencies between manual data entry versus AI-analyzed results, it provides early warning signs that are easy to miss otherwise.

By leveraging AI-driven financial insights, accounting professionals can make informed decisions that optimize cash flow while also ensuring compliance with tax laws and minimizing the risk of errors.

The Future of Accounting with AI

As we stand at the threshold of a new age, AI is transforming many industries, including accounting. But the power and potential of AI goes beyond just number crunching.

Gone are the days when accountants were mere record-keepers. With tools like ChatGPT, they’ve evolved into strategic advisors who make informed decisions based on valuable insights drawn from vast data sets.

The adoption of such advanced technology does not mean that machines will replace humans completely in the accounting profession. Complex tasks still need human intervention to make ethical choices, adapt to changes, and maintain professional standards as per regulations.

This transformation might seem intimidating, but it’s more about collaboration than competition between man and machine. It gives accountants room to focus more on strategic planning while leaving routine tasks like balance sheet preparation or tax return filing to efficient AI tools.

Futuristic technologies do not eliminate jobs; rather, they redefine them by automating routine processes, which ultimately boost efficiency and accuracy while reducing costs significantly.

How to Implement ChatGPT in Your Accounting Practice

If you’re looking to bring your accounting practice into the future, integrating ChatGPT is a smart move.

To implement ChatGPT in your accounting practice, you can follow these steps:

- Identify the tasks you want to automate. ChatGPT can be used to automate a wide range of accounting tasks, including data entry, invoicing, expense categorization, financial reporting, and tax compliance.

- Create ChatGPT prompts for each task. For example, a prompt for generating an invoice might be “Generate an invoice for client Acme Corporation for the amount of $1,000 for services rendered.”

- Test the ChatGPT prompts and make adjustments as needed. Once you have created a ChatGPT prompt for each task, test it to make sure that it is generating the desired output. Make adjustments to the prompt as needed.

- Integrate ChatGPT into your accounting workflow. Once you have tested and refined your ChatGPT prompts, you can integrate ChatGPT into your accounting workflow. This may involve creating templates or macros in your accounting software or simply using ChatGPT as a standalone tool.

Of course, these are just beginner steps. Here are some additional useful tips for implementing ChatGPT in your accounting practice:

- Start small. Don’t try to automate all of your accounting tasks at once. Start by automating one or two tasks, and then gradually add more tasks as you become more comfortable with ChatGPT.

- Be specific in your prompts. The more specific you are in your prompts, the better the results will be. For example, instead of prompting ChatGPT to “generate a report,” prompt it to “generate a balance sheet for the period ending December 31, 2023.”

- Review the output carefully. ChatGPT is still under development, and it may not always generate accurate results. It is important to review the output carefully before relying on it for any important decisions.

- Use ChatGPT in conjunction with other tools. ChatGPT is a powerful tool, but it is not a replacement for all accounting software. Consider using ChatGPT in conjunction with other tools, such as financial accounting software and tax preparation software, to get the best results.

By following these steps and tips, you can successfully implement ChatGPT in your accounting practice and automate a wide range of tasks.

FAQs About ChatGPT for Accounting

How can ChatGPT be used in accounting?

ChatGPT can streamline tasks, from data entry to financial reporting. It helps automate routine work and deliver faster insights.

Can ChatGPT solve accounting questions?

Absolutely. With its AI-powered processing, ChatGPT can tackle a wide range of accounting queries with precision and speed.

Did ChatGPT pass the CPA?

Yes, ChatGPT passed the CPA exam on its second attempt. In 2023, researchers at four universities trained ChatGPT on a dataset of accounting questions and then tested it on a practice CPA exam. ChatGPT passed the exam with an average score of 84.3%.

Is there an AI for accounting?

You bet. And that’s where tools like ChatGPT come into play – providing smarter automation solutions for the modern accountant.

Conclusion

ChatGPT for accounting is no longer a fantasy, it’s here and ready to transform your world. The power of AI in automating tasks, generating financial reports, ensuring compliance, and even managing cash flow has been unveiled.

We’ve journeyed through how ChatGPT streamlines processes, and boosts efficiency while providing key insights from vast data sets. And we explored the future – an era where accountants leverage this powerful tool not as replacements but as allies. The strategic advantage is immeasurable!

If you’re excited about what AI brings to the table, why wait?

Get started on implementing ChatGPT into your practice today and welcome a new age of productivity and precision. Your superhero assistant awaits!